LATEST

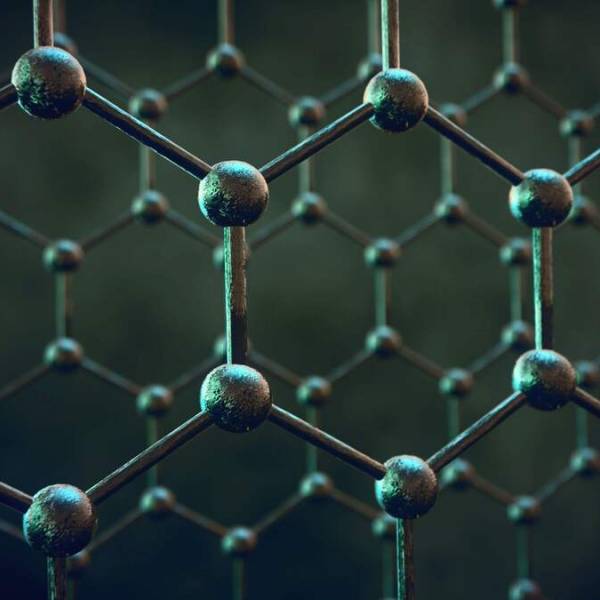

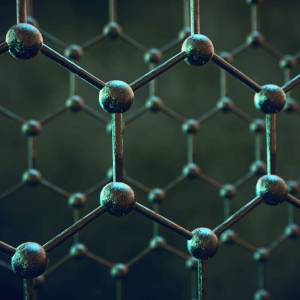

Manchester scientists have made a remarkable...

Thu, Apr 25th 2024In a thrilling breakthrough in the realm of...

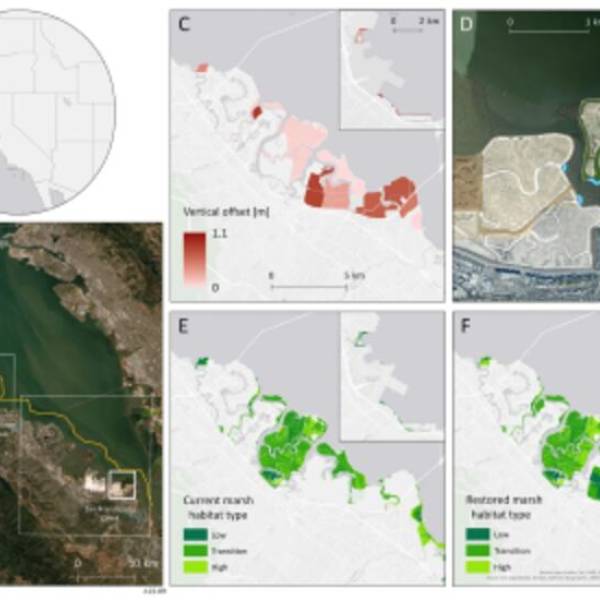

AI software revolutionizes plant engineering to...

Wed, Apr 24th 2024At Salk in La Jolla, researchers are collaborating...

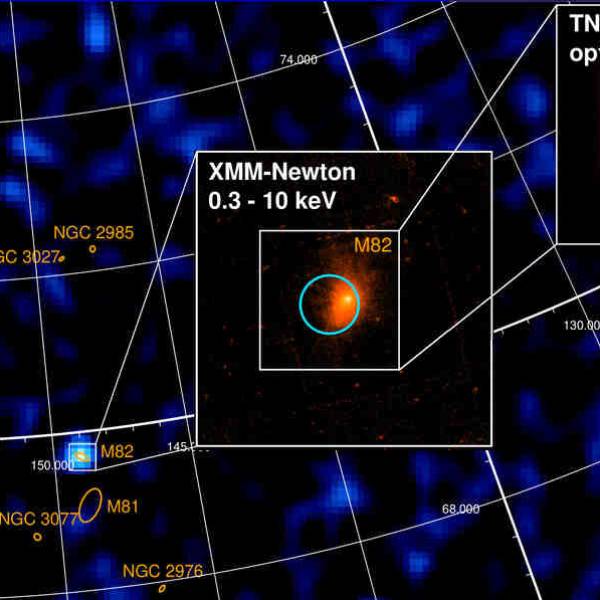

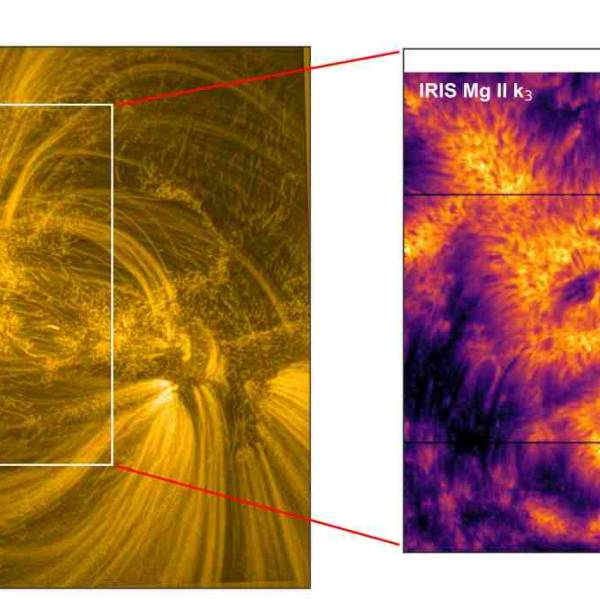

University of Geneva researches a massive magnetic...

Wed, Apr 24th 2024A groundbreaking discovery has been made by the...

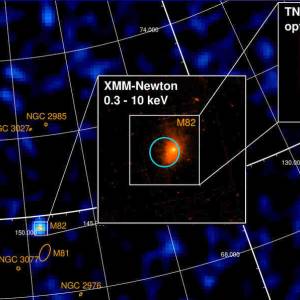

Supercomputer simulations uncover the dynamics of...

Tue, Apr 23rd 2024New research conducted by a team of scientists...

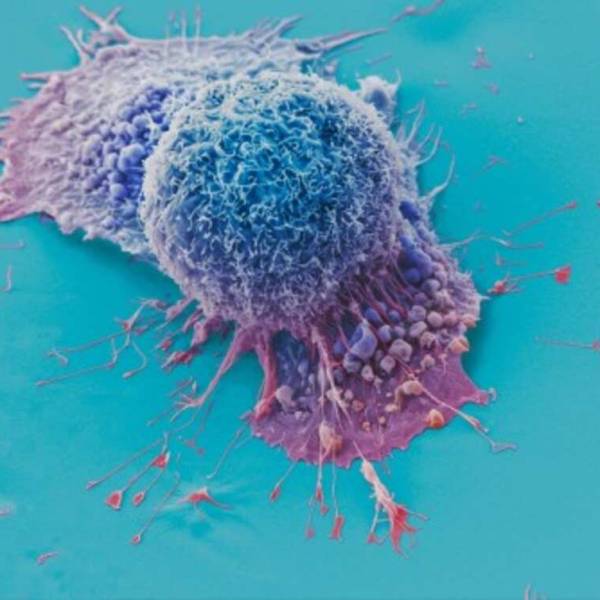

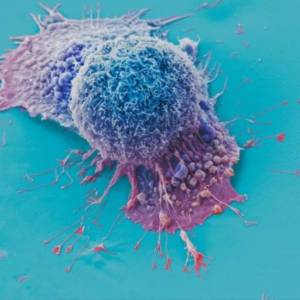

AI tool predicts responses to cancer therapy using...

Thu, Apr 18th 2024A recent study conducted by researchers from...