Intel sales drop by a third

Intel has reported terrible fourth-quarter sales, and the year-over-year (YoY) comparisons are just as painful.

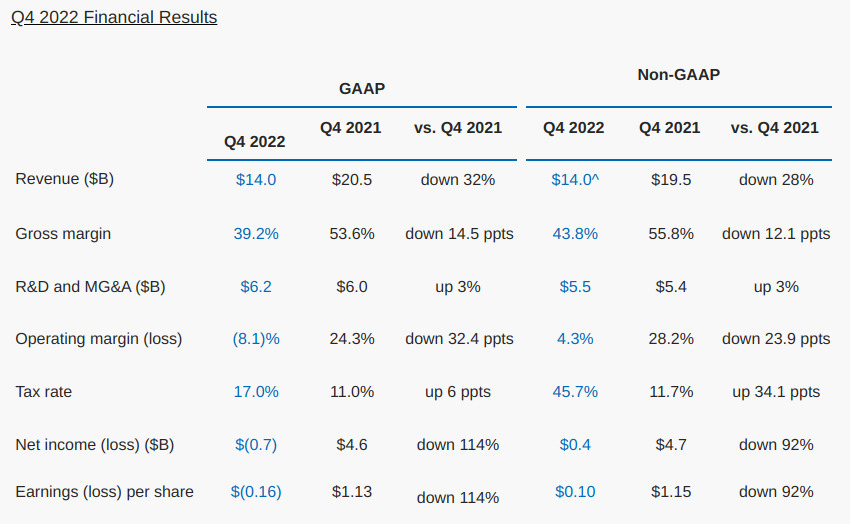

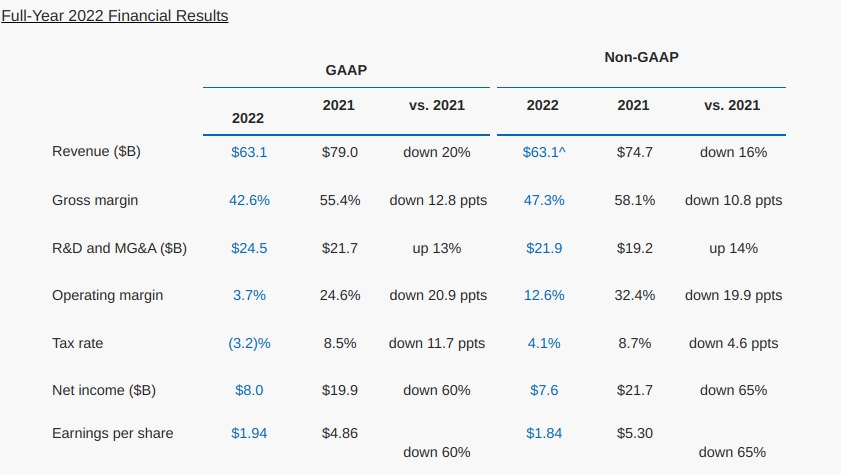

Fourth-quarter revenue was $14 billion, down 32% YoY, and $63.1 billion for the full year 2022, down 20% YoY.

Its data center and AI (DCAI) sales of $4.3 billion have plunged by 33% in the quarter.

The company's net income was painful; down 114% in the quarter and down 60% to $8 billion for the year.

As a result, Intel shares closed 6.4% lower today. It saw $8 billion wiped off its market value after it baffled Wall Street with dismal earnings projections. They have predicted a surprise loss for the first quarter, and its revenue forecast was $3 billion below estimates as it struggled with growing the data center business.

Intel previously announced several organizational changes to accelerate its execution and innovation by allowing it to capture growth in both large traditional markets and high-growth emerging markets. This includes the reorganization of Intel's business units to capture this growth and provide increased transparency, focus, and accountability. As a result, the company modified its segment reporting in the first quarter of 2022 to align with the previously announced business reorganization. All prior-period segment data has been retrospectively adjusted to reflect the way the company internally manages and monitors operating segment performance starting in the fiscal year 2022.

“Despite the economic and market headwinds, we continued to make good progress on our strategic transformation in Q4, including advancing our product roadmap and improving our operational structure and processes to drive efficiencies while delivering at the low end of our guided range,” said Pat Gelsinger, Intel CEO. “In 2023, we will continue to navigate the short-term challenges while striving to meet our long-term commitments, including delivering leadership products anchored on open and secure platforms, powered by at-scale manufacturing and supercharged by our incredible team.”

“In the fourth quarter, we took steps to right-size the organization and rationalize our investments, prioritizing the areas where we can deliver the highest value for the long term,” said David Zinsner, Intel CFO. “These actions underpin our cost-reduction targets of $3 billion in 2023, and set the stage to achieve $8 billion to $10 billion by the end of 2025.”

How to resolve AdBlock issue?

How to resolve AdBlock issue?